“taxes” Charts

Reefer Madness Could Bring Big Bucks »

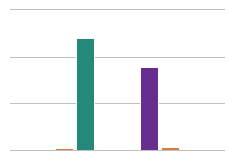

The generated tax from marijuana in Colorado could be massive according to a recent NBC survey. NBC spoke to 18…

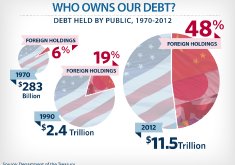

America the Broke: Owned by Others »

Because we have ignored balancing our budgets over the past few decades the public holds 11.5 trillion dollars of debt.…

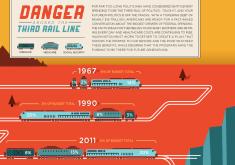

Danger on the Third Rail »

For far too long politicians have considered entitlement spending to be the third-rail of politics: touch it, and your future…

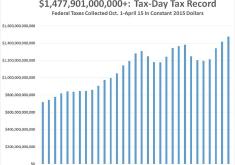

Record Breaking Tax Day »

$1.47 trillion, the amount collected this fiscal year in taxes, is the highest amount of taxes ever collected in one…

Tax Day: Just One-Third of Your Tax Bill »

Income taxes only account for about 36 percent of the $20,667 in total taxes paid by a typical American family.

Why Do We Coddle the Super-Wealthy? »

A paycheck -- that is, income from work -- is taxed at a higher rate than income from interest on…

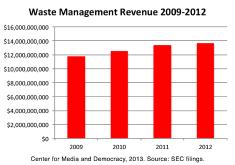

Waste Management Revenues Leave Taxpayers Scratching Heads »

Waste Management's revenues continue to rise, with the taxpayer-funded company taking in $13.65 billion in 2012, netting $1.3 billion in…

American Taxpayers Subsidize Fast-Food Industry's Low Wages »

A new study finds that 52% of fast-food workers receive either SNAP, Medicaid or Children’s Health Insurance Program (CHIP) benefits…

The GOP Is The Food Stamp Party »

It’s a well-known irony that states that tend to vote Republican—the party that constantly raves about the “makers” and trolls…

Americans Are Against Internet Sales Tax »

Americans would be against a law proposing an Internet sales tax, with stronger opinions skewing to the younger demographics. While…

The Dark Side of Overspending »

There’s a saying that goes, “shoot for the moon – even if you miss, you’ll land among the stars.” Unfortunately…

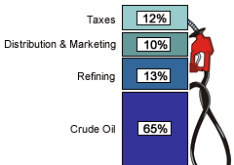

What We Pay For in a Gallon of Gasoline »

In April 2013, crude oil accounted for 65% of the total price that Americans pay for gasoline. 13% of the…

$10 Million Per Minute to Subsidize Fossil Fuels »

The fossil fuel industry receives a combined $5.3 trillion per year in subsidies from governments across the world. This is…

238 Years Later: No Taxation Without Representation »

Though we inherited our civilizational foundations from the United Kingdom, Americans have opposite views to our counterparts across the pond…

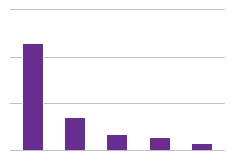

Drug Arrests: Directing Our Efforts for Social Well-Being »

Cannabis possession has little connection to violent crime and is considered a safe drug. At the same time cannabis possession…

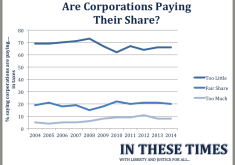

Americans Say Corporations Are Not Paying Their Share »

Americans have, for many years now, said that corporations are paying too little in taxes while the middle class suffers.…

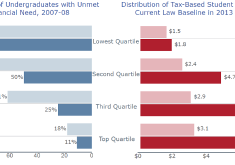

Students with Minimal Need Receive Most Tax-Based Aid »

In 2013, Tax Policy Center estimates that more than half of the benefits of the Tuition and Feeds Deduction and…

Obamacare, Minimum Wage Hike Would Increase Labor Costs »

A proposal to increase the federal minimum wage, coupled with existing employer mandates from Obamacare, would increase the minimum cost…

Should America Impose Tariffs? »

The ideas of protectionism are making a resurgence within the United States. Perhaps a result of Donald Trump's tough talk…

Should America Provide "Free" College? »

There are few things that prospective college students fear more than giant student loans. With the cost of college seemingly…

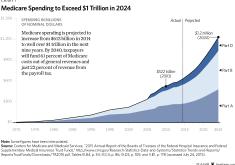

Medicare Spending to Exceed $1 Trillion in 2024 »

Medicare spending is projected to increase from $613 billion in 2014 to well over $1 trillion in the next nine…

You CAN Put A Price On Art: Less Than Five Dollars »

Sometimes a piece of art can be priceless, but that doesn't mean the American public wants to pay to see…

Tax Time: Expectation Vs. Reality »

When it comes to filing taxes, Americans don't plan to procrastinate, but they do so nevertheless. According to a recent…

Getting Paid For Being An American: The Negative Income Tax »

It can be great being an American, especially if you get paid for being one. According to a 2013 CBO…

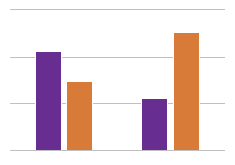

Going Wireless? It's Gonna Cost You »

For wireless consumers, the cost of going cordless can be hefty. Over the last few years, the average tax burden…

Besides Taxes, What Bothers You Most About Taxes? »

A majority of Americans have a bone to pick with the federal tax system for allowing wealthy corporations and individuals…

Who Pays Our Taxes? The Rich, Mostly. »

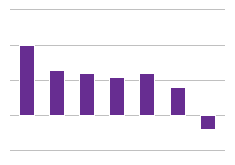

It is pretty well known that the American income tax system operates off of a progressive tax in which the…

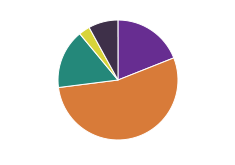

This Is How The Federal Government Is Funded »

When it comes to providing America's government with sufficient funds, it is undoubtedly a collective responsibility. Over 93% of all…

The Biggest Problems With Our Tax System »

The American federal tax system: its messy, convoluted, and, without a doubt, flawed. For the majority of Americans, however, the…

Do You Pay Your Fair Share Of Taxes? »

When it comes to ponying up to Uncle Sam, Americans are divided over the tax burden they hold. A slim…

Results: U.S. Bill Prohibiting Taxpayer-Funded Abortions »

On January 22, the U.S. Congress passed a controversial bill that will permanently ban tax funding for abortion costs, including…

Taking Another Look At Income Inequality »

Income inequality is increasing throughout the United States, right? Examining before-tax income differences, it would certainly appear so. Taking a…

Head of Household Income Tax Brackets for April 15, 2015 »

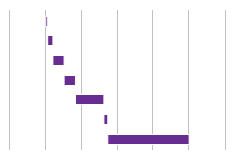

To be clear, the tax bracket at 39.6% extends to any amount above $432,201. The chart was capped at $1…

How Should America Reduce Its Deficit? »

When it comes to trimming down the federal budget deficit, Americans heavily favor spending cuts over tax increases. Nearly three…

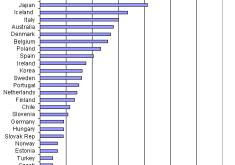

American Property Taxes Are Far Too High »

According to the Tax Foundation, the United States has the 32nd most competitive tax system out of 34 OECD countries.…