Who Pays Our Taxes? The Rich, Mostly.

by Christian Stellakis on Mar 29, 2015 | Views: 394 | Score: 0

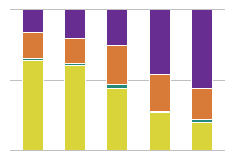

| % of Returns Filed | % of Income Tax Payed | |

|---|---|---|

| < $15,000 | 25.1 | 0.2 |

| $15,000 - 29,999 | 20.8 | 1.5 |

| $30,000 - 49,999 | 17.5 | 4.5 |

| $50,000 - 99,999 | 21.6 | 16.1 |

| $100,000 - 199,999 | 11.2 | 22.7 |

| > $199,999 | 3.8 | 55 |

Adjusted Individual Gross Income Level

Sources:

pewresearch.org

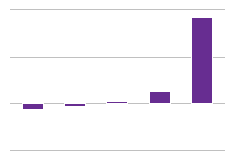

It is pretty well known that the American income tax system operates off of a progressive tax in which the wealthy pay a greater percentage of their income than the poor. But how heavy is the tax burden for each income group, exactly? A recent Pew Research study found that the highest income bracket within the United States pays about half of the total income tax despite making up less than four percent of all the tax returns filed.

Interesting choice of words - how "heavy is the burden" for each group. I'd suggest that the "burden" for the >200k is pretty light compared with the burden felt by the 15-30k group where every dollar can make a difference in whether or not you can pay your bills, buy food, etc.

I agree with Noah; I think he hit the nail on the head. This clearly demonstrates the huge economic disparity between the rich and the poor in America.