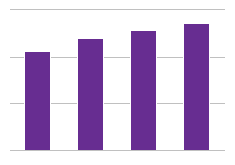

Head of Household Income Tax Brackets for April 15, 2015

by SavvyRoo on Dec 8, 2014 | Views: 204 | Score: 0

| Income tax due... 10% | 0 | 12950 |

|---|---|---|

| 15% | 12951 | 49400 |

| 25% | 49401 | 127550 |

| 28% | 127551 | 206600 |

| 33% | 206601 | 405100 |

| 35% | 405101 | 432200 |

| 39.6% | 432201 | 1000000 |

Household Income

Sources:

bankrate.com

To be clear, the tax bracket at 39.6% extends to any amount above $432,201. The chart was capped at $1 million to allow the other brackets to be visible. The staggered tax system is meant to keep the poor from being unduly burdened by having the rich pick up some of the slack. Does it accomplish its goal?