“financial” Charts

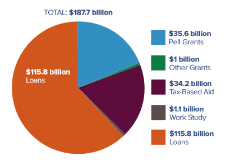

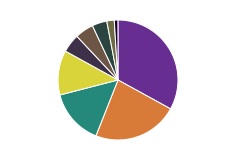

Breakdown of Federal Student Aid »

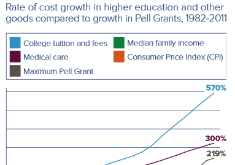

Students cannot afford any further Pell Grant reductions; this year's $5,635 maximum Pell Grant covers less than one-third of the…

Medicare and Social Security’s Cloudy Future »

Predicting your financial future is hard. Markets tank, rates go up, and kids play 52 card pick up with your…

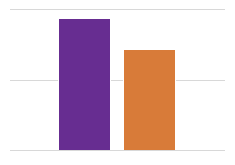

Economic Independence: Men vs. Women »

When it comes to financial independence, women have some serious catching up to do. While slowing increasing, the percent of…

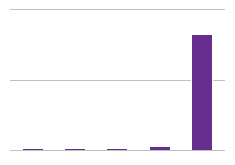

The One Financial Tech Company To Rule Them All »

When it comes to dominating the financial tech marketplace, one company eviscerates all other competition. Paypal absolutely crushes all other…

Our Financial Resolutions: How Did We Do? »

When it comes to the future of handling their finances, Americans take their New Year's resolutions pretty seriously. For each…

The Struggles Of Small Business »

It's certainly not easy developing a small business in the United States. Business owners face financial problems on a variety…

The Most Successful Movie Sequels »

Movie sequels: we love them and we hate them. Far more than any other sequel to date, Boondock Saints II:…

Growing Coop Sector Across The Pond »

Despite being the birthplace of modern-day cooperativism, the UK’s co-op sector has remained relatively small. However, since the financial crisis,…

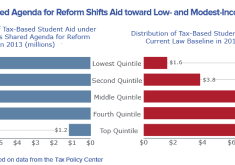

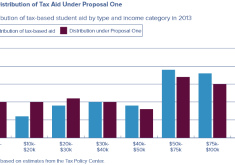

What Tax-Based Student Aid Could Look Like »

Under proposals, tax-based student aid would go to the low- and modest-income families and individuals who most struggle with college…

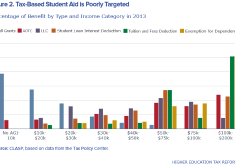

Why We Need Student Aid Reform »

Despite research showing that low/ modest-income families are more likely to respond to changes in college costs and student aid,…

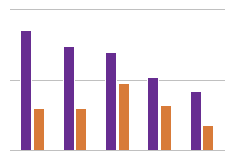

What Potential Reform Can Do For Tax-Based Student Aid »

This chart shows the value of tax-based student aid by income category before and after the changes in Proposal One…

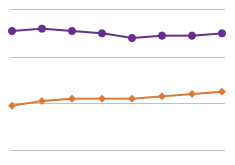

Growing Gap: College Costs and Financial Aid »

Over the last three decades, college costs have increased nearly four times faster than median family income. Financial aid has…

Credit Card Balance: Compulsive Versus Non-Compulsive Buyers »

In this study, compulsive buyers had higher average credit card balances per respondent when compared to other respondents. The average…

Credit Card Debt: Compulsive Versus Non-Compulsive Buyers »

Among those surveyed, compulsive buyers had a higher average of credit cards per respondent that had debt within $500 of…