Credit Card Debt: Compulsive Versus Non-Compulsive Buyers

by BeyondThePurchase.Org on Oct 18, 2013 | Views: 241 | Score: 0

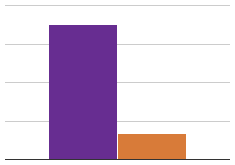

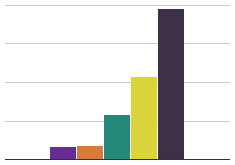

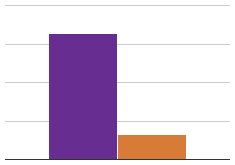

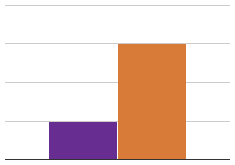

| Compulsive Buyers | Other Respondents | |

|---|---|---|

| Credit Card Debt Within $500 of Limit | 1.56 | 0.52 |

Mean Number of Credit Cards Per Respondent With Debt Within $500 of Limit

Sources:

ajp.psychiatryonline.org

Among those surveyed, compulsive buyers had a higher average of credit cards per respondent that had debt within $500 of the credit card limit when compared with non-compulsive buyers. A higher prevalence of credit card debt among compulsive buyers reveals a link between compulsive purchasing tendencies and financial mismanagement.