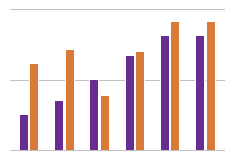

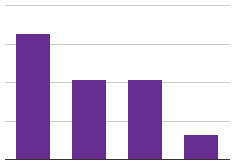

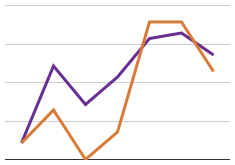

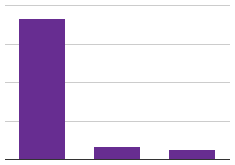

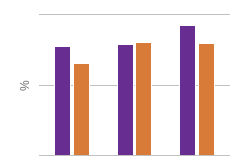

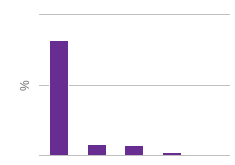

| Top .001% Income-Earners | 90-99.99% | 80-90% | 60-80 | 40-60 | 20-40 | |

|---|---|---|---|---|---|---|

| 1960 | 71.4 | 34.58 | 17.4 | 16.7 | 15.9 | 13.9 |

| 1970 | 74.6 | 36.76 | 20.5 | 20.7 | 20.2 | 18.5 |

| 1980 | 59.3 | 40.1 | 26.7 | 24.5 | 21.4 | 16.3 |

| 1990 | 35.4 | 31.06 | 26.2 | 24.3 | 21 | 16.2 |

| 2000 | 40.8 | 34.82 | 26.4 | 23.9 | 20 | 13.1 |

| 2004 | 34.7 | 30.1 | 22.7 | 20.5 | 16.1 | 9.4 |

Total federal tax rate paid by American households, grouped by income

Tax Rates for American Households

Sources:

elsa.berkeley.edu, economix.blogs.nytimes.com

of

of

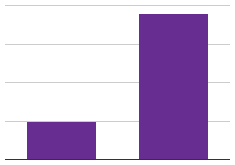

As Congress and the President have argued how to handle the federal deficit, disagreement invariably arises over raising taxes. While President Obama has called for tax increases on the upper-class, Republicans have insisted rather on even more stringent spending cuts. Since the 1960s, rates for the highest income-earners have precipitously dropped, while, for the middle-class, they have increased.