Why A Worthless Company Can Still Have Huge Stock Growth

by Anthony Sibley (AJ) on Feb 15, 2015 | Views: 370 | Score: 0

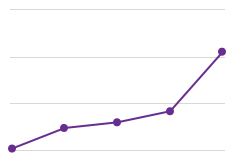

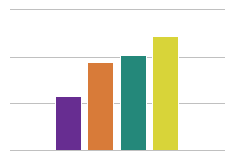

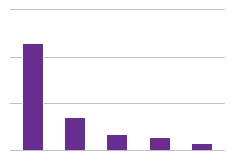

| NSDQ Yahoo Stock Price (% Change)* | 3rd Quarter Revenue (% Change) | |

|---|---|---|

| 2010 | 19.14 | 1.64 |

| 2011 | 13.67 | -24 |

| 2012 | 28.98 | -1.23 |

| 2013 | 23.15 | -5.22 |

| 2014 | 50.44 | 0.8 |

Year-over-Year Percentage Change

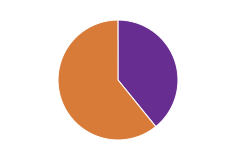

Stock Prices from Second Week of September

Since the sixth CEO in five years took over, Yahoo, Inc.'s stock price has increased over 125%. Nevertheless, Wall Street investors consider the Yahoo to be worth effectively less than zero, as its assets are worth more than the company itself. Yahoo owns a share of the Chinese site, Alibaba, worth roughly $37 billion and a stake in Yahoo Japan worth over $8 billion. But Yahoo's market value is a mere $39 billion. While Yahoo's sites continue to be some of the most popular online, the company's core business has proven incapable of effectively monetizing its huge internet traffic.