Below are the key stats we are currently tracking.

Meetings Scheduled - Monthly

| Stretch | Target | Actual | |

|---|---|---|---|

| Nov | 0 | 0 | 2 |

| Dec | 0 | 0 | 10 |

| 16 | 60 | 40 | 32 |

| Feb | 60 | 40 | 23 |

| Mar | 60 | 40 | 45 |

| Apr | 70 | 50 | |

| May | 70 | 50 | |

| Jun | 70 | 50 | |

| Jul | 80 | 60 | |

| Aug | 80 | 60 | |

| Sep | 80 | 60 | |

| Oct | 80 | 60 | |

| Nov | 80 | 60 | |

| Dec | 80 | 60 |

We hit our goal!!! High fives all around and big kudos to Alejandro for all his work on this. After another slow start to the month (an unfortunate trend that will repeat in April as Alejandro is out for the first couple of working days), we turned it around and were 11% over goal. Yeah!!

Originally I set our goals with an escalating scale going from 40/mth to 50 and then 60. I'm not sure how I feel about those escalated numbers at this stage, but for now I am leaving the goals as they are.

Meetings Scheduled - YTD

| Stretch | Target | Actual | |

|---|---|---|---|

| Nov | 0 | 0 | 2 |

| Dec | 0 | 0 | 12 |

| 16 | 60 | 40 | 44 |

| Feb | 120 | 80 | 67 |

| Mar | 180 | 120 | 112 |

| Apr | 250 | 170 | |

| May | 320 | 220 | |

| Jun | 390 | 270 | |

| Jul | 470 | 330 | |

| Aug | 550 | 390 | |

| Sep | 630 | 450 | |

| Oct | 710 | 510 | |

| Nov | 790 | 570 | |

| Dec | 870 | 630 |

We have closed the gap a little bit on the YTD goal.

Active Pipeline

| Negotiating | DeMBO | Pre-DeMBO | Pre-Meet | |

|---|---|---|---|---|

| January | 7 | 12 | 13 | |

| February | 1 | 4 | 14 | 18 |

| March | 2 | 5 | 15 | 16 |

The pipeline improved again. That's good news.

* Definitions

DeMBO - Decision Maker/Business Owner. We are meeting with someone we believe can make the buy decision.

Pre-DeMBO - We are meeting with someone who needs to connect us with or lobby someone else in the organization to get the decision made.

Pre-Meet - We have scheduled but not yet had our first meeting with the prospect.

# of Companies Digging - Monthly

| Stretch | Target | Actual | New Target | |

|---|---|---|---|---|

| 16 | 2 | 1 | 0 | |

| Feb | 3 | 2 | 0 | |

| Mar | 3 | 2 | 0 | |

| Apr | 4 | 2 | ||

| May | 4 | 3 | ||

| Jun | 5 | 3 | 0 | |

| Jul | 5 | 4 | 1 | |

| Aug | 6 | 4 | 2 | |

| Sep | 6 | 4 | 2 | |

| Oct | 7 | 5 | 2 | |

| Nov | 7 | 5 | 3 | |

| Dec | 8 | 5 | 3 |

So. Still with the sales cycle.

I've added the "New Target" line to this and the following charts to look at how this would appear if we had given ourselves a six month ramp up for sales. (Six months being the ramp up time that John suggested we might face.)

Is this a long sales cycle? Or is this a product people won't buy? I'd be lying if I said this wasn't a question I contemplate. Having said that we have implemented yet another round of improvements to (a) shorten the cycle and (b) increase likelihood of sale.

# of Companies Digging - YTD

| Stretch | Target | Actual | New Target | |

|---|---|---|---|---|

| 16 | 2 | 1 | 0 | |

| Feb | 5 | 3 | 0 | |

| Mar | 8 | 5 | 0 | |

| Apr | 12 | 7 | ||

| May | 16 | 10 | ||

| Jun | 21 | 13 | 0 | |

| Jul | 26 | 17 | 1 | |

| Aug | 32 | 21 | 3 | |

| Sep | 38 | 25 | 5 | |

| Oct | 45 | 30 | 7 | |

| Nov | 52 | 35 | 10 | |

| Dec | 60 | 40 | 13 |

Can't make our YTD without hitting our monthly. First things first, we need to get that first company signed up.

Revenue - Monthly

| Stretch | Target | Actual | New Target | |

|---|---|---|---|---|

| 16 | 24000 | 12000 | 0 | |

| Feb | 36000 | 24000 | 0 | |

| Mar | 36000 | 24000 | 0 | |

| Apr | 48000 | 24000 | ||

| May | 48000 | 36000 | ||

| Jun | 60000 | 36000 | 0 | |

| Jul | 60000 | 48000 | 12000 | |

| Aug | 72000 | 48000 | 24000 | |

| Sep | 72000 | 48000 | 24000 | |

| Oct | 84000 | 60000 | 24000 | |

| Nov | 84000 | 60000 | 36000 | |

| Dec | 96000 | 60000 | 36000 |

All revenue targets are based on an assumed average deal size of $12,000. This would be 20 players at $600 per player. We continue to hear that our pricing seems pretty doable. Now we just need someone to do.

Revenue - YTD

| Stretch | Target | Actual | New Target | |

|---|---|---|---|---|

| 16 | 24000 | 12000 | 0 | |

| Feb | 60000 | 36000 | 0 | |

| Mar | 96000 | 60000 | 0 | |

| Apr | 144000 | 84000 | ||

| May | 192000 | 120000 | ||

| Jun | 252000 | 156000 | 0 | |

| Jul | 312000 | 204000 | 12000 | |

| Aug | 384000 | 252000 | 36000 | |

| Sep | 456000 | 300000 | 60000 | |

| Oct | 540000 | 360000 | 84000 | |

| Nov | 624000 | 420000 | 120000 | |

| Dec | 720000 | 480000 | 156000 |

We still believe we are on the right path. It just has a longer first few steps than expected. We're getting closer and look forward to more positive progress next month.

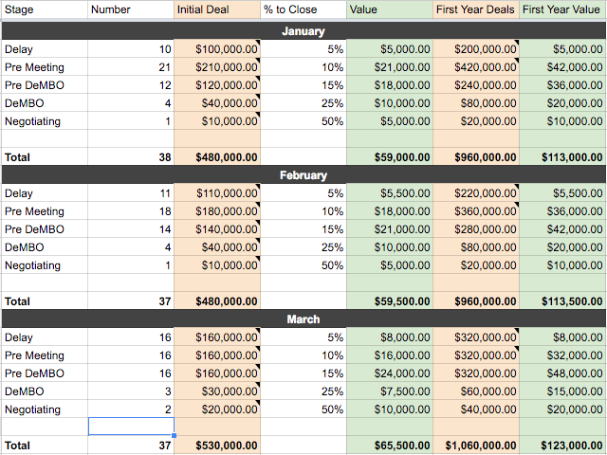

Pipeline Data Dive

What is significant in this? I think mostly just the fact that the total numbers are growing. So our pipeline is improving. Obviously this only matters if deals close. But assuming they do, this pipeline spreadsheet shows that our numbers are moving in the right direction.

The "% to Close" estimate is still a WAG (wild ass guess). The "Initial Deal" is based on an assumed $12,000 average first deal. This feels like it is in the right ballpark for a pilot based on most conversations so far. "Value" is the product of the total deals times the likelihood of close. And "First Year" numbers are based on assumption that on average the companies who pilot with us will do at least one more deal worth an additional $12,000 in year one. Lots of assumptions here, but this is helping us get a general sense of what's coming down the pike and what we need to do.

of

of

I shared a couple of your recorded cold calls with some members of my team at lunch yesterday. They were in awe - your efficiency and effectiveness at getting the meeting beat anything they have heard. You have embraced the essence of everything we have talked about and simply nail it on each call. With your permission, I would like to use one of your calls as an example of how to do it right at a breakout session I am conducting at the American Association of Inside Sales Professionals in San Francisco on Feb 18. Of course a SavvyRoo DIG promo will be embedded in the intro!

Happy to have you use my call. Would love to know which one you use. Thanks so much for that reinforcement. It's always helpful to hear.