How Do We Save Social Security? Eliminate the Payroll Cap

by United for a Fair Economy on Oct 30, 2013 | Views: 238 | Score: 0

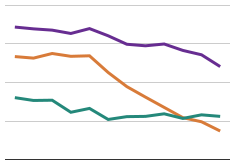

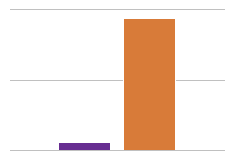

| % of Income Paid toward Social Security | |

|---|---|

| $20,000 | 6.2 |

| $40,000 | 6.2 |

| $80,000 | 6.2 |

| $110,100 | 6.2 |

| $220,020 | 3.1 |

| $440,400 | 1.6 |

| $506,000 | 1.3 |

| $1,000,000 | 0.7 |

| $10,000,000 | 0.07 |

| $20,000,000 | 0.03 |

Annual Income

Sources:

faireconomy.org, faireconomy.org

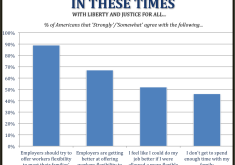

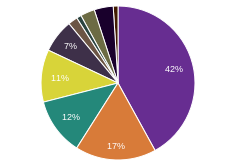

Every worker pays social security taxes on their earned income, but there is no tax on annual pay above $113,700. Of those workers with earnings above that amount, 100% are high income, roughly 81% are white, and 77% are men. Those who can most afford to contribute to the social security pot are given an unneccesary and costly free ride.