“tax” Charts

The Best Vanishing Act Since Houdini: The IRS E-mails »

The IRS says that due to a computer crash, email correspondence that could possibly incriminate the Internal Revenue Service is…

The Real-World Money Tree?!?! »

Colorado is seeing GREEN. Both kinds. And lots of it. The legal marijuana-market is far exceeding the $70 million annual…

Are Tax Cuts A Good Thing? »

Republicans often claim that tax cuts, particularly for the wealthy, will boost the economy so much that they will pay…

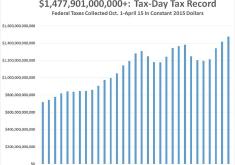

Record Breaking Tax Day »

$1.47 trillion, the amount collected this fiscal year in taxes, is the highest amount of taxes ever collected in one…

Medicare and Social Security’s Cloudy Future »

Predicting your financial future is hard. Markets tank, rates go up, and kids play 52 card pick up with your…

Tipping the Rich, Taxing the Rest »

As Congress and the President have argued how to handle the federal deficit, disagreement invariably arises over raising taxes. While…

The Evolution of America's Smoking Habits »

As the extent of the negative health effects of cigarette smoking dawned on the American population over the past few…

Chairman Ryan’s Supposed Budget Slashing »

Chairman Paul Ryan’s budget supposedly cuts federal government spending by $5.1 trillion over the next ten years. However, this slash…

The Truth Behind ALEC's Funding »

The American Legislative Exchange Council (ALEC) claims to be the largest voluntary membership group of state legislators in the country,…

The American Paradox: More Social Programs But No Tax Hikes »

In our aversion to anything that could mean higher taxes or income redistribution, Americans sell themselves short in attaining popular…

A Popularity Contest for the Ages: Best Government Agencies »

While not exactly your high school's prom king and queen, certain government agencies maintain much higher levels of popularity than…

Who pays the Obamacare individual mandate tax? »

In 2016, about 4 million people are projected to pay the Obamacare individual mandate tax. Nearly 70 percent of those…

What Tax-Based Student Aid Could Look Like »

Under proposals, tax-based student aid would go to the low- and modest-income families and individuals who most struggle with college…

Tax-Based Student Aid Not Targeting Those Who Need It Most »

Low-income students still attend college at lower rates than high-income students. The lowest-income students are only one-seventh as likely as…

What Are Americans Paying For At The Pump? »

With the national average price for regular gasoline at $3.55, many Americans bemoan the high prices at the pump. There…

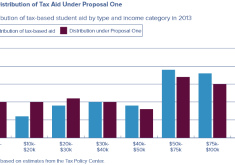

What Tax-Based Student Aid Could Look Like Under Reforms »

Proposal Two is an attempt to preserve the benefits of Proposal One while addressing its potential shortcomings. Both recommendations improve…

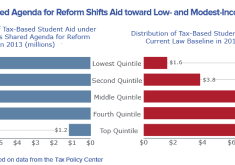

What Potential Reform Can Do For Tax-Based Student Aid »

This chart shows the value of tax-based student aid by income category before and after the changes in Proposal One…

Tax-Based Student Aid Largest form of Non-Loan Federal Aid »

Since the late 90's, tax-based student aid has more than quadrupled and now represents more than half of all non-loan…

Internet Sales Tax is Unpopular »

The taxing of items purchased over the internet is widely unsupported by young people, but more than half the country…

ALEC Denies Bill Tracking Despite Obvious Evidence »

The American Legislative Exchange Council (ALEC) has secretly lobbied for the adoption of its corporate-backed bills and tracked them for…

Wall Street's Policy Agenda Results in Rich Getting Richer »

History has proven that properly regulated Main Street market economies ensure that the middle class flourishes, and wealth distribution is…

Corporate Profits Setting Record Highs »

Wall Street's forty-year campaign has recently allowed corporate profits to soar, while high unemployment looms for Americans. Real community wealth…

Tax-Based Student Aid Mostly Benefits High-Income Households »

Currently, tax-based student aid provides less benefit to low-income students than high-income students. It is important that we improve how…

America's Voters: Misinformed, and Misinformed About It »

94% of Americans regularly watch news media, and 57% of Democratic voters and 53% of Republican voters felt they encountered…